Sigma-Tau-Omega-Rho-Mu

of the STORM Collective

December 2021

PROLOGUE

From 2011 to 2015, the government State Corporations’ share in the Bursa Malaysia had a value worth of RM$720 billion which – as part of Kuala Lumpur Composite Index (KLCI) – means an increase from 43.7% to 47.1% in the total market capital RM$1.7 trillion value of the country’s publicly listed companies. It is

sizeable as only 35 of these State Corporations’ were accounting for 42% of the government-link companies (GLCs). The majority of these GLCs are owned and controlled by the Ministry of Finance Incorporated.

(Mehmet, 1986) that is, cartel-like networks acting in collusion to concentrate wealth. In addition, various state governments, through their respective State Economic Development Corporations, also came to own corporate entities as SEDCs.

1] INTRODUCTION

Following the various resolutions at The First and subsequently Second Bumiputera Economic Congress, in 1965 and 1968 respectively, (see the submission by Abdul Majid Haji Mohamed in O/C Economic Affairs, Penang UMNO to Tuan Haji Abdul Wahab, Dato Panglima Bukit Gantang, Ipoh, 19 September 1946, UMNO Papers, UMNO/SG, 82/1946, Arkib Negara Malaysia (hereafter ANM) that eventually would emerge as the core policies that were implemented in the New Economic Policy (NEP). This policy formulation would be the pivotal and directional shift towards state-sponsored capitalism, specifically ethnocapitalism-concentrated upon execution, (see Baharuddin, From British to Bumiputra rule: local politics and rural development in Peninsular Malaysia, 1986; Lim Mah Hui, Capitalism and Industrialization in Malaysia, 1982.

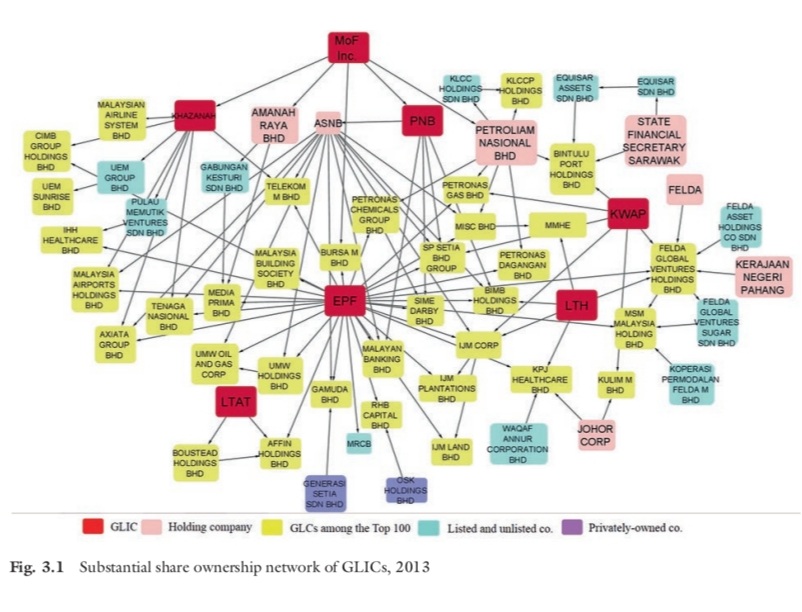

Of these state corporations, seven institutions have been classified by the government as government-link investment corporations (GLICs) in addition to the Minister of Finance Incorporated (MoF Inc.): Lembaga Tabung Haji (Pilgrims Savings Fund) LTH and Kumpulan Wang Persaraan Diperbadankan (Retirement Fund Incorporated) KWAP. The others are Permodalan Nasional Bhd (PNB) or the National Equity Corporation), the Employees Provident Fund (EPF), Khazanah Nasional Bhd and Lembaga Tabung Angkatan Tentera (LTAT) or Armed Forces Fund Board.

While Khazanah and PNB were incorporated under the Companies Act, the other five GLICs are statutory bodies. Four of the seven GLICs – EPF, KWAP, LTH and LTAT – are pension or special purpose funds; the EPF and KWAP are pension funds for employees.

These GLICs, thus, in various forms function as holding company, special purpose fund, sovereign wealth fund, trust fund manager and pension fund.

2] ECONOMIC NATIONALISM AND ETHNOCAPITAL

Economic nationalism directs the returning of foreign resource ownership to national control after Western firms had over-stayed in “developing” nations during the colonial era in pursuit of more exclusive bumiputera (sons of the soil) capital generation and retainment.

Economic nationalism involves, and entails, two prime aspects: firstly, the accumulation of capital on behalf of bumiputeras; secondly, the appointment of bumiputeras at the decision-making and managerial levels, thus realigning to structure and manage economic development as a determined ethnocratic economy destiny.

This economic nationalism posturing capriciously as affirmative action policy differs from those of other countries. It is “the politically dominant majority group which introduces preferential policies to raise its economic status as against that of an economically more advanced minorities“ (see Puthucheary seminal work, written while in a prison, on the Ownership and Control of the Malaysian Economy, and the continuous in-depth studies by Gomez, with Jomo and Lim Mah Hui – collectively critical of selective privatisation and bumiputera equity quotas, and in the promotion of money politics that are acutely detrimental to national economic development; see also 50 years NEP hasn’t worked and NLM#10.

Since post-independence there is an ethnocratic governance where representatives of an ethnic group is holding a disproportionately large number of public posts to advance their ethnic group to the disfranchisement of others, (see Winter, J.A., Oligarchy, Cambridge University Press, 2011, and Wade, G., The Origins and Evolution of Ethnocracy in Malaysia, Asia Research Institute, National University of Singapore, Working Paper Series 112, April 2009), including, see NLM#13: introducing political Islam in administrative governance.

The emerging stratification of wealth – more so after the introduction of the New Economic Policy (NEP), consolidated through NEM (New Economic Model), and now re-enforced with BEEP (Bumiputra Economic Empowerment Plan) has a congregation of players who are empowered by tremendous riches which they employ, and deploy rather ruthlessly, in collusion with political ethnocrats who are powerful not because of wealth, but because of their positions (offices or status) thereby deepening and intensifying the class contradictions within society.

At the initial phase of NEP implementation, the hegemonic ruling party, United Malays National Organisation (UMNO) and its business associates of party leaders were owners of many publicly listed GLCs. The power nexus involving politics and business is such that KUB ( a cooperative-based company that was owned by UMNO members ), the huge construction-based UEM Group, the hotel-based Faber Group (now UEM Adgenta) and the Utusan Melayu, the publisher of Malaysia’s leading Malay newspaper, Utusan Malaysia were part of UMNO’s involvement in the corporate sector with the party riddled with money politics, patronage and rent-seeking.

Indeed, at one time, when a feud emerged between premier Mahathir and his finance minister Daim, companies controlled by the latter’s allies and UMNO were channelled to the GLICs and GLCs – where Mahathir then took charge of the Ministry of Finance. It was concentrated controlling: more tightly so as consequence outcome of the problems exposed by the 1997 Asian Financial Crisis (AFC 1997) as market overreaction and herding caused the plunge of exchange rates, asset prices and economic activity to be more severe than warranted by the initial weak economic conditions permeating the region, and the weak politico-economic structure of nation (see an Overview assessment by Olin Liu et al in their Malaysia: From Crisis to Recovery, IMF Occasional Paper No. 207).

With entrenched political power – wielding authority over or directing the behavior of rakyat2, whether in economic, social lives or cultural (including religion) – the accumulation of capital to the ruling class continues expanding. We shall say that political economy of Malaysia needs to be analysed on a class basis because it entails producing, expropriating, and distributing surplus value of rakyat2 labour – especially when these processes are by rent seekers in collusion with monopoly-capital.

3] CLIENTELE CLASS

Neoclassical theory premises on individual preferences, resource endowments and technological capability, while Marxian theory begins with class and class processes. Nicos Poulantzas conceives a concept of class “places” as distinguished from class positions where “places” exist at each of the these levels of society: political and economics like the Prime Minister Department’s Ministry of Finance Incorporated.

By ethnocapital we mean a ruling regime’s State Comporate owns and controlls an entity performing under a rentier or clientel capitalism thrust whether it is a public agency, a government-linked company (GLC) or a public trust fund or a special vehicle enterprise.

A) THE PLACE AND CONTROLLING CLASS

Though the need for the UMNO president to reduce the influence of party warlords, the level of centralization in capital’s power of domination, even more marked than the concentration of capital, reinforces the interpenetration of economic and political power.

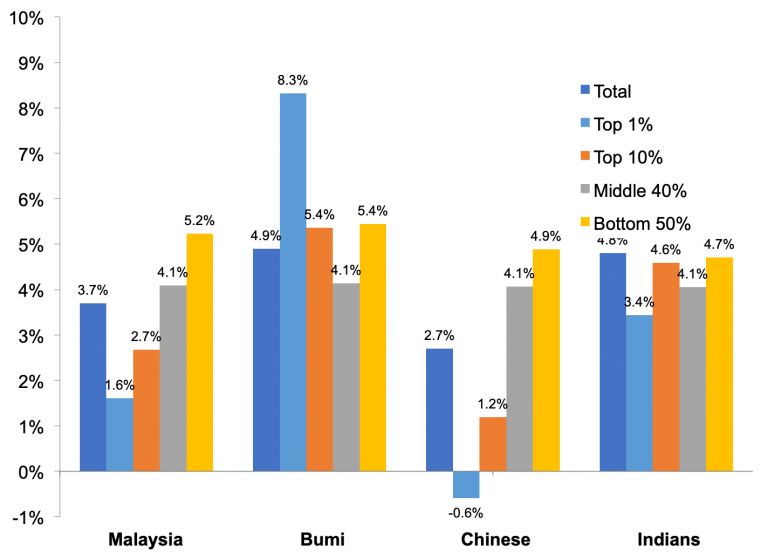

The issues relating to where the economic power emits from could be identified from the stronghold of clientelism and the ensuring political clientel relationship where ownership and control player (the Prime Minister) in the Ministry of Finance Incorporated [place] had aligned with economic entities [positions] in promoting rentier capitalism to sustain his hold and control of said entities [power]. It adopts this clientelism as solicitations for allegiance of party members and at the grassroots level, allowing designated Member of Parliament and or Ministers of ruling elites [place] the party patronage [position] and political [power] to “effectively partisanizing them and ensuring ground-level officials with whom most voters interacted with ……are political party loyalists” (Weiss, 2020), resulting in the skewed distribution of profits by political stakeholders and the stark inequality of wealth permeating in the country (Khalid):

There is every reason to say that patronage position is never ever removed from place nor the prescence of the ruling elite and the political power that oozes therefrom. Indeed, ruling elites are the biggest “owners” of divisional-level by UMNO or Perikataan National constituency places with the office-bearing posts that defined political positioning posts with the ensuing power distributing spoils that emit from that place and position therein. This is similar to what in management term that owners and managers if are taken as a whole, are elements of the same class. Their differences on this issue are of degree and not of kind. The ownership of the place loci, by situating in a position, the control of vested power elements is explicit, and the gaining – and retaining – of accumulated wealth whence maintained and sustained is definite.

The recent disclosure from the Pandora Papers only highlighted the immense amount (RM$1.7 trillion which is even more than the national debt of RM$1.2 trillion in 2020) that was expropriated, stolen and hived abroad by ruling cliques and their cronies under oligopolistic ethnocapitalism.

B) POSITIONING THE CLASS DOMINATION

The two class processes of capitalism are defined as the extraction and distribution of surplus labour in the form of value. The class positions of the capitalist fundamental class processes are productive workers (performers) and productive capitalists (extractors). Capitalists appropriate surplus value from the consumption of labour power during the production of commodities. The surplus is distributed among occupants of subsumed class positions associated with say the state, merchants, financiers, landlords, managers and monopolies. Therefore, class position is determined by the relationship of the individual to the appropriation and distribution of surplus value.

That positioning presupposes a “place” is already in place or existence – and it is within these GLICs’ and GLCs’ State Corporations.

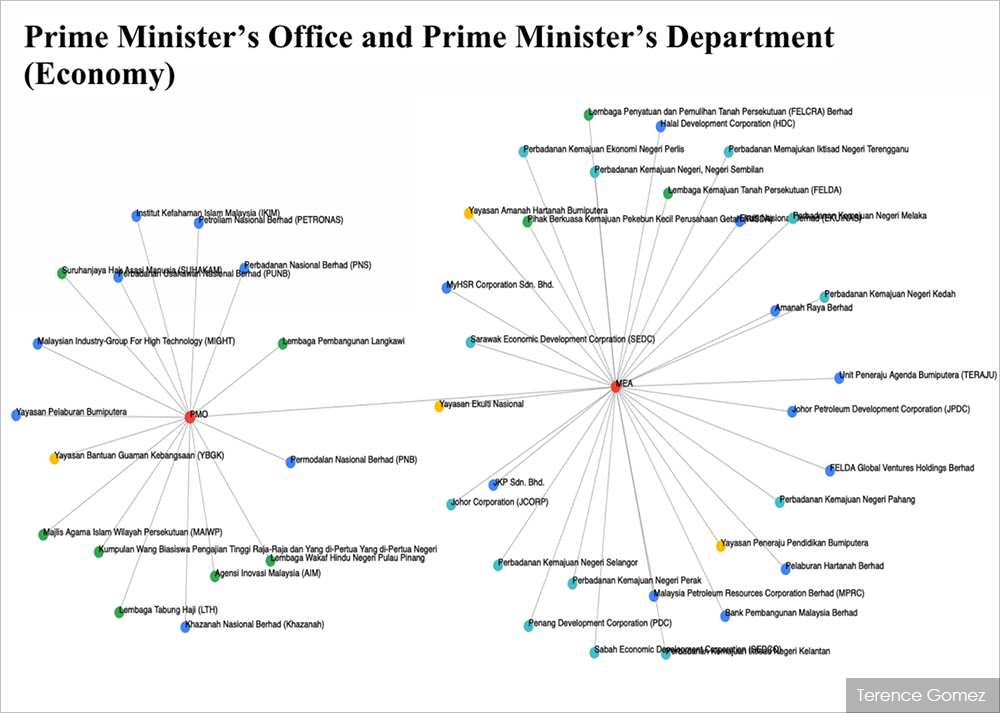

Gomez was able to identify the various and variety of places that those State Corporations exist, resides and dominate the national economy. Further, he extended to demonstrate how Control is effected by a specific algorithm known as “beta centrality” or “Bonacich’s power” which measures the power of an enterprise within a network of firms (with a reference to assessing of social networks as per Bonacich 1987); that both centrality and power were a function of the connections of the actors in one’s neighborhood. The more connections the actors in your neighborhood have, the more central you are. The fewer the connections the actors in your neighborhood, the more powerful you are :

With the Minister in Finance at its apex, any premier is well placed to dictate the pattern of development of the corporate sector. The MoF Inc. served as an important mechanism for any premier to retain and consolidate power. This pyramid structure in place, the prime factor crucial in terms of control of the GLICs and GLCs is through directorships where the chairman oversees the board of directors, and the MD is responsible for the management of the enterprise. By controlling these twin positions, the Minister of Finance can have effective control over the running each of the GLICs and GLCs entities overall.

These seven business groups have extensive ownership of key sectors of the economy that enbraces banking, plantations, media, property development and construction, and oil and gas. The implications of this method of ownership and control of the State Corporations means the endowment of power centralization gives a good reason on why a reluctancy by Mahathir to create an all-round national capitalist class, but instead prefers in indulging and assuming a governance by the wealthy that is plutocracy wearing the sarong of an anti-democratic regime.

4] MONOPOLIES OF CAPITAL

In the accumulation of wealth by these State Corporations by which we mean the Ministry of Finance Incorporated owned and controlled its entities whether it is a public agency, a government-linked company (GLC) or a privatised and or commercial enterprise like Pharmanagia or a telecommunications service provider like TM — the digital knight as an intermediary to the throne of infrastructural platforms – is an aspect of State Corporations performing under a rentier or clientel capitalism domain.

A good case-firm study is PNB (see firesstorms’ The Financialisation of PNB Capital) which has assets under management (AUM) of RM$312 billion (as at 31 December 2019 compared to RM$266.5 billion assets under management as at Dec 31, 2016) where its portfolio covers strategic investments in Malaysias’ leading corporates, global equities, private investments and real estate. PNB, thus, is the second biggest institutional investor after state-run Employees Provident Fund (EPF) and has accumulated deposits, by April 2008, of RM120 billion (25% of GNP).

As a government-linked corporation, PNB is a unique ‘hybrid’ being both investment company and fund manager. The Corporation was formed with a specific mandate to raise income and savings levels through spreading corporate ownership more evenly throughout the Malaysian economy, particularly amongst the lower income indigenous Bumiputera communities. PNB runs what is reckoned to be the world’s largest unit trust scheme, and manages investments which rake up at least 22 per cent of Kuala Lumpur’s Stock Exchange value.

PNB is targeting towards RM$350B by 2022; under its stables, PNB holds 48% of Maybank, 52% in Sime Darby, 58% in UMW, 70% in CCM, 66% (Setia) and 59% (MNRB) – all GLC State Corporations.

ii) FELDA has evolved from a land settlement agency to a plantation company with all the negative aspects of capitalism excess, (see Keith Sutton and Amriah Buang, Geography, Vol. 80, No. 2, April 1995) where lowly-paid foreign labour is exploited to harvest yields rather than done by the settler-owners or their children themselves; and when monopoly-capital siphoned off the surplus value of migrant labour and the wealth of settlers through financialization capitalism by way of credit payments on food items and loans repayments on household equipment and leased vehicles.

With its corporatisation as Felda Global Venture (FGV), settlers’ loans towards replanting and housing within the settlement indebted the community folks to the tune of RM$8 billion. Owing to lack of adequate funding, and the delayed implementation of housing for the second-generation settlers, the anak-anak of many settlers have to live outside the land schemes or migrate to industrial estates to seek employment in an urban living.

iii) PETRONAS: Four GLICs have an interest in KLCCP Holdings, which in turn owns Suria KLCC, the owner of the Petronas Twin Towers. The MoF Inc. has a majority interest in KLCCP Holdings through wholly owned Petronas, which has a direct and indirect 75.5% share in this listed firm through KLCC Holdings Sdn Bhd.

Despite MoF Inc.’s dominant shareholding of KLCCP, three other GLICs also have a stake in the company with PNB as the second largest GLIC shareholder, through ASNB, with a total 7.81% interest :

It has to be stated that capitalism State Corporations’ monopolies had not brought much progress in the rural area. Instead, it had retarded development and fossilized institutional process changes. This is as a result of suppression of class struggles in the rural environment. For instance, the opening up jungle land for settlement and the introduction of green revolution have not introduced income growth among the peasantry, but instead perpetuates the feudal capitalism to enslave the peasantry into persistent poverty. It also underlines the role of state capitalism where PETRONAS as the national state entity in supporting the Big Oil transnational corporations that provide the fertiliser material input to the peasantry – rice farmers and FELDA settlers – who has to feed the urban proletariat in a Circuitry of Capital:

|

iv) Pharmaniaga is given sole distribution rights on the Pfizer’s vaccine in Malaysia (Boustead Holdings owns 55.93% of Pharmaniaga, while Lembaga Tabung Angkatam (LTAT) owns 11.12%, as at May 29, 2020, and through a reverse ownership, the major owner of Boustead Holdings is LTAT).

Ruling regimes through the years have been acting not unlike a tripartite healthcare agent: as a public healthcare provider and regulatory agency, as financial capitalisation with it’s own private hospitals in Sime Darby, Pantai, Khazanah, KPJ Healthcare Berhad, and as rentier capitalism with a disposition to the private pharmaceutical companies.

Pharmaniaga is such an intermediary Big Pharma GLC.

The role of Pharmaniaga in the public healthcare system is essentially acting as a middleman. It is rare for countries to rely on a single concessionaire company to supply biopharmaceutical products, and for such a long period of time, too. More than an ownership, Pharmaniaga is the sole concession holder to purchase, store, supply and distribute both branded and generic approved drugs and medical products to 148 government hospitals and 2,871 clinics and district health offices nationwide.

Of the RM27 billion allocated for public healthcare in 2018, at least RM2.5 billion was for medical supplies and RM1.6 billion for consumable and medical support items. Indeed, with 100% market share of the government concession, more than RM1 billion goes to Pharmaniaga annually whence the GLC had a 10-year concession agreement with the Ministry of Health (MoH).

v) An GLC entity resting as an intermediary on one side of infrastructural platform thrones of Global North monopoly-capital and at another corner as part of ruling elites’ corporate capital: is Telekom Malaysia or TM – the digital knight. As a GLC, it is government-funded, financialisation capitalised from foreign banking institutions and provision of hardware and software by Global North monopoly-capital stakeholders.

Through the years, TM had spent some RM$20 billion in establishing fixed line telephony, over RM$4.4 billion on copper broadband, RM$16 billion for fibre broadband and another RM$2.2 billion on mobile infrastructure in the country excluding other financial outlays that likely obtained healthy returns of investment from over 40 major projects including such real estates development as the Empire City and Emira Residence, Selangor and the Bayu Creek Precinct 7 in Johor state, besides the development of smart cities in the states of Sabah and Sarawak that encompass a broad range of digital transformation activities, including as the Cloud Service Provider to government services, education, and transportation – all beneficiaries to rentier capitalism.

As being the “last-mile” controller to the internet world, all other telecommunication broadband providers like Digi, Maxis, Time, P1, Yes, Celcom, etc. have to be dependent upon accessibility to the fibre optics and wireless connecting hubs to reach their eventual site destinations for their respective end users. In a sense, TM is the shining knight intermediary controller dictating, and dominating, all the surfing serfs of endusers data crunching and information gathering needs.

According to the World Bank Group, Telekom Malaysia (TM) has such a strong market dominance which essentially stifled competition and led to poor coverage and high prices for broadband internet in the country.

5] CONCLUSION

The rent-seeking ethos surrounding the particular burden of privilege class in the oligarchy community is clientelism capitalism. Under this format of clientelism, goverment-link companies are formulated to entice loyalty, and to retrieve the generous accumulation of surplus wealth generated. This GLC clientelism capital nowadays not only linked to Global North monopoly capital, but often inconspicuous is the GLC-SOE (state-owned enterprise) partnership whereby countries controlling very powerful enterprises could implement major projects, completely bypassing the private sector, (Gomez et al, China in Malaysia: State-Business Relations and the New Order of Investment Flows), where SOEs endowed with development financial institutions (DFIs) they are playing the dual prime role in financing development and project management, too.

i) That at a time of stagnant growth for the next twenty years (Sudhave Singh, 2020), and within a political economy that is geared in focusing and concentrating on saving kleptocrates’ enterprise to support local capital and external monopoly-capital than caring for a rakyat2 economic wellbeing, it is appropriate to revive a national investment towards wholesome wealth-creating for all, Malaysian communities in a sharing common prosperity domain. However, the AFC 1997 crisis had created an intra-elite political feuding environment amongst different major ethnocapital actors in the corporate world. The GLICs’ bailout of ailing politically well-connected companies and their takeover of firms associated with ousted UMNO leaders only accentuated the different business competitive turfs since then among the cohort of ethnocapitalists

Ii) That the government must not only redress its growing fiscal deficit, but also expedite its program of divestment, and to maintain and sustain a high growth trajectory path (World Bank 2021 Report) which is not easily achievable with present politico-economic model.

iii) That there is empirical evidence where the presence of GL is in general has a discernible negative impact on non-GLC investment in Malaysia (see ADB 2013).

iv) That firms tend to invest less when the share of GLC revenue in a particular industry is large

v) That when GLCs account for a dominant share of revenues in an industry, investment by private firms in that industry is significantly negatively impacted

vi) That an authoritarian state capitalism – where the state is simultaneously an actor and the arbiter of economic life is not conducive to a commonality in wealth-sharing ethos

vii) That the inefficient public companies like State Corporations whereby not some but many a gross had become states within the state administered by political appointees or minister-in-charges themselves as cronies to ethnocapitalism and or be colluding profiteers in capitalism

viii) That while a growing fiscal deficit and rising dominance of GLCs may both be crowding out private investment, a genuine privatization program designed to reduce the role of GLCs would also have to address the fiscal constraint (see NLM#12 on the 12th. Malaysia Plan) to revive the investment climate, otherwise this approach is still within a neoliberalism economic development scheme than towards a truly socialism ideal platform.

EPILOGUE

Wealth generating entities have to be the special rakyat-purpose vehicles at the service of an inclusive Malaysian community-based economic development renaissance.

BIBLIOGRAPHY

Asia Development Bank Are Government-Linked Corporations Crowding out

Private Investment in Malaysia?; No. 345 | April 2013

Foster What is monopoly-capital

Gomez et al MINISTER OF FINANCE

INCORPORATED Ownership and Control of Corporate Malaysia

IDEAS https://www.ideas.org.my/govt-needs-a-serious-look-into-the-proliferation-of-glcs-say-panellists/

¤¤¤

CAPITALISM ¤ CAPITAL CIRCUITRY ¤ CAPITAL CLASS ¤ CAPITAL AND LABOUR ¤ CAPITALISM COVID-19 CRISIS ¤ CAPITALISM STATE CORPORATIONS ¤ CAPITALISM DEVELOPMENT CHINA LEARNS ¤ CAPITALISM THE LEFT CHALLENGES ¤ CAPITALISM CONFRONTS ECOLOGY ¤ COPITALISM ¤